According to Law360, Multinational companies moved an estimated 37% of profits, nearly $1 trillion, to so-called tax havens in 2019, according to a United Nations study.

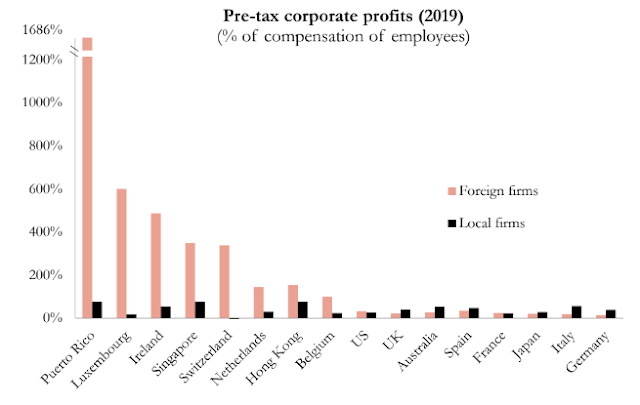

The study's authors defined tax havens as having "excessive profitability of foreign firms" and effective corporate tax rates of less than 15%. They said the growth of corporate profit shifting dovetailed with the increasing profitability of multinational enterprises.

These tax jurisdictions are Andorra, Anguilla, Antigua and Barbuda, Aruba, The Bahamas, Bahrain, Barbados, Belgium, Belize, Bermuda, the British Virgin Islands, the Cayman Islands, Cyprus, Gibraltar, Grenada, Guernsey, Hong Kong, Ireland, the Isle of Man, Jersey, Lebanon, Liechtenstein, Luxembourg, Macau, Malta, Marshall Islands, Mauritius, Monaco, Netherlands, the Netherlands Antilles, Panama, Puerto Rico, Samoa, Seychelles, Singapore, St. Kitts and Nevis, St. Lucia, St. Vincent &

Grenadines, Switzerland, Turks and Caicos, Vanuatu.

Among tax havens, Puerto Rico still stands out with an exceptionally high profits-to-wage ratio of about 1,600 per cent for foreign firms. In Ireland, the profits-to-wage ratio of foreign firms dropped from about 800 per cent to less than 500 per cent over the 2015–19 period.

One of the authors, Ludvig Wier, said in a news release that the findings of the study point to "a dire need for additional policy initiatives to significantly reduce global profit shifting," and called on countries to implement the globally agreed-upon deal for a 15% minimum corporate tax.

Need International Tax Advice?

for a FREE Tax Consultation Contact Us at:

or Toll Free at 888-8TaxAid (888 882-9243).

No comments:

Post a Comment