There are ways to defend against these

automatic assessments and request penalty abatement. The defenses that you

should consider when assess the penalty for filing an international

information return after the due date.

- Follow the Delinquent Information Return

Procedure – No longer available after November 9, 2020 - see Reasonable Cause Defense below.

Taxpayers who have identified the need to file delinquent international information returns who are not under a civil examination or a criminal investigation by the IRS and have not already been contacted by the IRS about the delinquent information returns should file the delinquent information returns through normal filing procedures. Taxpayers may attach a reasonable cause statement to each delinquent information return filed for which reasonable cause is being asserted. During processing of the delinquent information return, penalties may be assessed without considering the attached reasonable cause statement. It may be necessary for taxpayers to respond to specific correspondence and submit or resubmit reasonable cause information.

- Ask for a First-Time Offender Abatement (FTA) - Generally, an FTA can provide penalty relief if the

taxpayer has not previously been required to file a return or has no prior

penalties (except the estimated tax penalty) for the preceding three years

with respect to the same IRS File (IRM §20.1.1.3.6.1). With

respect to a Form 5472 late-filing penalty, the IRM provides for an FTA if

an FTA was applied to the taxpayer's related Form 1120 late-filing penalty

or no penalty was assessed on the related Form 1120 (IRM §21.8.2.20.2).

- Reasonable Cause Defense - Under Section 6038 of the tax code, which lays out the

information reporting requirements for individuals and businesses with an

interest in foreign corporations and the penalties for delinquent filing,

penalties may be abated if a reasonable cause exists for the failure to

file. However, neither the statute nor the applicable regulations define a

reasonable cause standard for the abatement. Treasury Regulations Section

301.6651-1(c) provide a definition of what constitutes reasonable cause

for failure to file corporate income tax returns and says that "if

the taxpayer exercised ordinary business care and prudence and was

nevertheless unable to file the return within the prescribed time, then

the delay is due to reasonable cause." And

Though a $25,000 penalty may discourage some from filing in international information return after the deadline, there is a greater exposure to not late filing and information return and that is that the statute of limitations for tax returns which is generally three years does not apply for returns that are missing the information reports and the statute remains open indefinitely. Under the indefinite statute of limitations, not only can the IRS make adjustments to items related to the international information returns, but they also can examine any other area on the tax return.

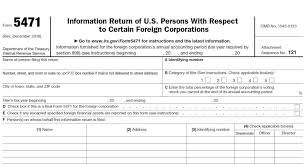

Has Your Company Been Assessed an

Automatic $25,000 Penalty for a Late Form 5472?

No comments:

Post a Comment