Many American estate tax

preparers who prepare returns infrequently fall into a trap. The

general concept that many preparers have is that assets passing to a

surviving spouse qualify for a marital deduction under section 2056 which

basically exempts all assets passing to a surviving spouse from

taxation in the estate of the first to die. Read the fine print before you go any

farther.

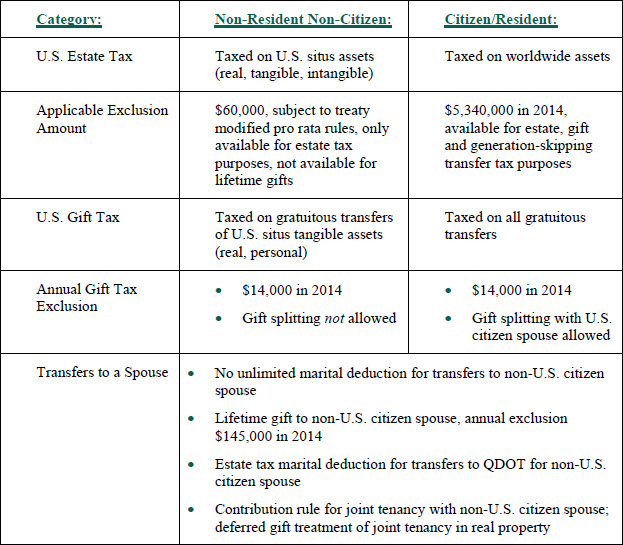

Since 1998, the rules of

changed a bit. True, the property still must pass to a surviving spouse to

qualify for the marital deduction but that spouse must be a US citizen. Being a

US resident taxpayer or a green card holder is not enough to fill the

bill. Remember the words "must be a US citizen". But what if assets

pass to a surviving spouse who is not a US citizen? In order to level the

playing field, the Congress created, via section 2056A, the Qualified Domestic Trust.

This trust must satisfy

certain special requirements to qualify for the marital deduction.

The executor of the estate, who must be a citizen of the United

States, must make an irrevocable election to create a QDOT on form 706-A.

The trust has certain requirements unlike usual Q-tip trusts. If the assets are

below $2 million, a US trustee must be appointed and is responsible for to

paying any tax. Each time there is a corpus distribution to the surviving

spouse, the trustee must file a form 706-QDT with the IRS and pay the deferred

portion of the tax. If the trust contains more than $2 million, the

trustee must be a US financial institution or, in the alternative, the estate

can post a bond with the Internal Revenue Service. This QDOT can be created

posthumously by the US trustee or the estate.

Think of it in terms of an interest-free loan. The estate may owe the IRS several hundred thousand dollars. The payment of that amount of money is deferred, free of any interest or penalty, until corpus distributions are made to the surviving spouse.

I

am currently aware of one case in which, to date, a payment in excess of $1

million has already been deferred for eight years. The spouse is in her 50s and

has taken no distributions from the trust corpus. Actuarially, she could live

for another 33 years which means that, in essence, this estate is received an

interest free loan on $1 million from Uncle Sam for basically one third of the

century. Even my own uncles wouldn't give me such a deal!

Think about it the

next time you prepare an estate tax return where the surviving spouse receives

the assets but is not a citizen of the United States. The time value of

deferring repayment of a loan by 33 years is less than 3%!

If the glove fits,

put the estate into the QDOT!

Robert S. Blumenfeld - Senior Estate Tax Audit Counsel

Mr. Blumenfeld concentrates his practice in the areas of International Tax and Estate Planning, Probate Law, and Representation of Resident and Non-Resident Aliens before the IRS.

Prior to joining Marini & Associates, P.A., he spent 32 years as the Senior Attorney with the Internal Revenue Service (IRS), Office of Deputy Commissioner, International.

Have a US Estate Tax Problem?

Estate Tax Problems Require

an Experienced Estate Tax Attorney

Contact the Tax Lawyers at

Marini & Associates, P.A.

for a FREE Tax Consultation Contact US at

or Toll Free at 888-8TaxAid ( 888 882-9243).

888 882-9243).

Robert S. Blumenfeld - Senior Estate Tax Audit Counsel

Mr. Blumenfeld concentrates his practice in the areas of International Tax and Estate Planning, Probate Law, and Representation of Resident and Non-Resident Aliens before the IRS.

Prior to joining Marini & Associates, P.A., he spent 32 years as the Senior Attorney with the Internal Revenue Service (IRS), Office of Deputy Commissioner, International.

While with the IRS, he examined approximately 2,000

Estate Tax Returns and litigated various international and tax issues

associated with these returns.As a result of his experience, he has extensive knowledge of the issues

associated with and the preparation of U.S. Estate Tax Returns for

Resident and Non-Resident Aliens, Gift Tax Returns, Form 706QDT and

Qualified Domestic Trusts.